can cash app report to irs

Learn about the Cash App scams here as they emerge. Go to IRSgovVITA download the free IRS2Go app or call 800-906-9887 for information on free tax return preparation.

Cash App Taxes 2021 Review New Name Same Free Tax Experience Tom S Guide

Cash App Taxes is 100 free and doesnt offer paid tiers or add-on services.

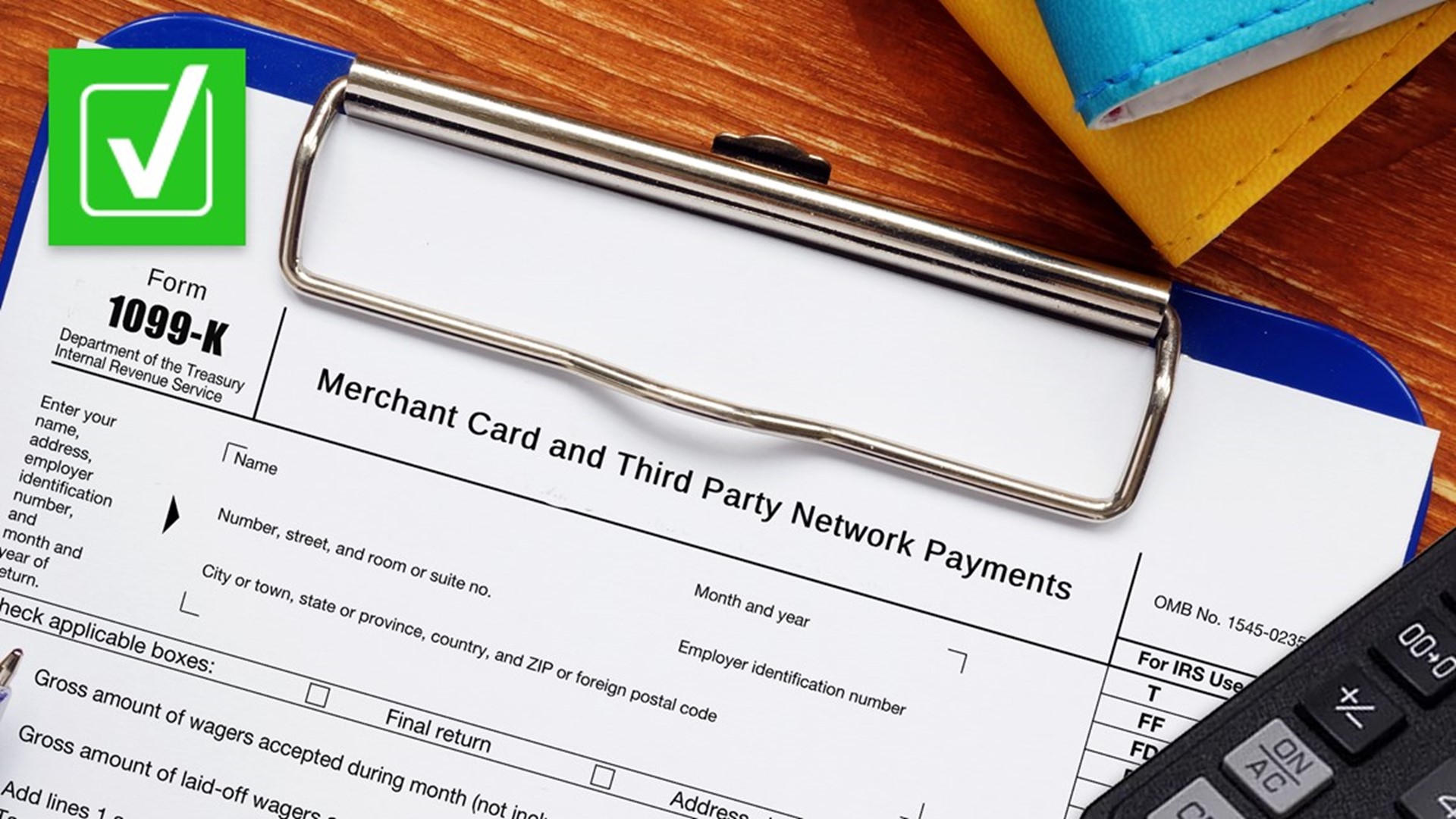

. Those posts refer to a provision in the American Rescue Plan Act which went into effect on January 1 2022 according to which anyone receiving 600 per year using Venmo PayPal Zelle or Cash App will receive a 1099-K and be required to report that income on their taxes. To determine the standard mileage rate lets look at Publication 3 and multiply the rate times the number of miles. The organization may have applied to the IRS for recognition of exemption and been recognized by the IRS as tax-exempt after its effective date of automatic revocation.

To check whether an organization is currently recognized by the IRS as tax-exempt call Customer Account Services at 877 829-5500 toll-free number. You can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Cash apps like Venmo Zelle and PayPal make paying for certain expenses a breeze but a new IRS rule will require some folks to report cash app transactions to the feds.

Actual cash or money orders bank or certified checks etc is used to make the purchases. This is ostensibly so the IRS can track your basis and properly check your calculations for taxes owed at the time of withdrawal. So far there isnt one other than supporting Squares goal of.

Other scams involving Cash App include the classic IRS scam informing the user of a debt owed to the IRS or perhaps a different entity and asking for payment through the Cash App. The new reporting requirement only applies to sellers of goods and services not. The Tax Counseling for the Elderly TCE program offers free tax help for all taxpayers particularly those who are 60 years of age and older.

The IRS will let you use the standard mileage rate for a military move. Whether you must report your scholarship or fellowship grant depends on whether you must file a return and whether any. NW IR-6526 Washington DC 20224.

The IRS allows lodging costs but not food. Cash in savings bonds for education costs without having to pay tax on the interest. So your total allowable expenses includes 300 for the motels and your mileage expenses.

A dealer is required to file a form 1099-B with the IRS to report proceeds paid to a non-corporate seller. So whats the catch.

Cash App Taxes Review Forbes Advisor

Tax Reporting For Cash App For Business Accounts And Accounts With A Bitcoin Balance

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Cash App Tax Forms All Tax Reporting Information With Cash App

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Does Cash App Report To The Irs

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You

Cash App Income Is Taxable Irs Changes Rules In 2022 Chosen Payments

Tax Reporting For Cash App For Business Accounts And Accounts With A Bitcoin Balance

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Cash App Transaction History View Download And Delete Cash App

Cash App Taxes Review Free Straightforward Preparation Service

Cash App Taxes Review 2022 Online Tax Software With No Fees Ever Cnet

Cash App Won T Have New Taxes In 2022 Despite Claims

What Cash App Users Need To Know About New Tax Form Proposals 12newsnow Com

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates